StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Macro & Microeconomics

- The Impact of Inflation on Global Economy

Free

The Impact of Inflation on Global Economy - Literature review Example

Summary

Most of the countries irrespective of developing, developed or underdeveloped are the victims of inflation. The following literature review briefly discusses the impact of inflation on the global economy, reasons and possible remedial measures of inflation.…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94.7% of users find it useful

- Subject: Macro & Microeconomics

- Type: Literature review

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: seamus87

Extract of sample "The Impact of Inflation on Global Economy"

Inflation and global economy Running Head: Inflation and global economy The Impact of Inflation on Global Economy Inflation and global economy 2

Abstract

Inflation is one of the serious problems as far as the global economy is concerned. Most of the countries irrespective of developing, developed or under developed are the victims of inflation. This article briefly discusses the impact of inflation on global economy, reasons and possible remedial measures of inflation.

Introduction

Inflation, in terms of economics, is a universal economic phenomenon in which the prices of all commodities go on increasing except money. All the countries are experiencing the problems caused by inflation. Public concern about inflation, generally result in outbursts against the ruling government. It is difficult for the economists to predict the inflation. “Public tends to express serious alarm once the inflation rate rises above 5 or 6 percent. Public opinion polls show minimal concern about rising prices during the early 1960s, as inflation was low. Concern rose with inflation in the late 1960s and early 1970s. When inflation twice surged to double-digit levels in the mid and late 1970s, Americans named it public enemy number one. Since the late 1980s, public anxiety has abated along with inflation itself” (Rebecca Hellerstein, 1997)

The Impact of Inflation on Global Economy

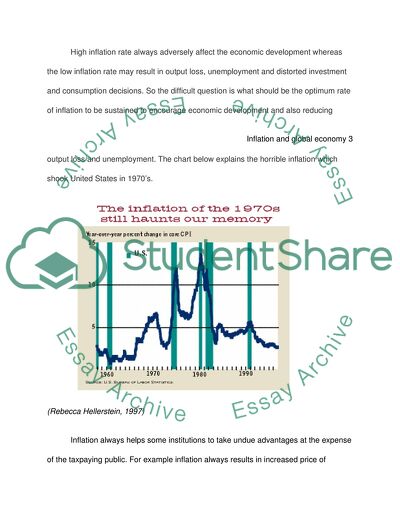

High inflation rate always adversely affect the economic development whereas the low inflation rate may result in output loss, unemployment and distorted investment and consumption decisions. So the difficult question is what should be the optimum rate of inflation to be sustained to encourage economic development and also reducing

Inflation and global economy 3

output loss and unemployment. The chart below explains the horrible inflation which shook United States in 1970’s.

(Rebecca Hellerstein, 1997)

Inflation always helps some institutions to take undue advantages at the expense of the taxpaying public. For example inflation always results in increased price of essential commodities. The increased price of oil may result in increased fairs in transportation sector and the general public may be forced to pay more for the transportation facilities. All the taxes or charges of the essential commodities like, energy (electric power), water supply, communication facilities (telephone, internet)

Inflation and global economy 4

transportation etc will be increased by the government if the inflation goes to a higher level. The ultimate victim will always be the public.

“If you think your bank deposits are yielding a princely return of 8 per cent a year, remember that you give up about 5-7 per cent of that to inflation. Your `real returns, that is, the rate at which your money is actually growing would be just 1-3 per cent a year. Therefore, a focus on `real returns and inflation has a bearing on every aspect of your financial plan” (Aarati Krishnan) Same way people do get fooled about their wages also. People often satisfied by their wages without having any idea about the real value of their wages. A 1000 dollar increase in salary may accept with both hands by the employees. But they are not aware of the fact that even that increased amount may not be enough for them to meet the daily expenses because of inflation. Concern about living standards also stems from the widespread belief that inflation pushes up prices before it pushes up wages. Many people understand prices rise because of inflation. But they seem to attribute nominal increases in their wages more to their own accomplishments than to the feedback effect of inflation. (Rebecca Hellerstein, 1997)

Zero inflation or lower inflation may result in deflation in which some of the higher priced commodities will find it difficult to adjust with the lower prices due to inflation. Those who depend on agricultural yields will suffer drastically under such situations. Their agricultural products may fail to obtain good price and at the same time they may forced to buy goods at a higher price. Such situations will never farmers and the farmers will be forced to stop cultivation which may ultimately result in the decreased yield of

Inflation and global economy 5

food grains of the country. In such situations a self sufficient country may be forced to import goods which will retard the economic progress. Thus deflation or lower inflation rate is also harmful to the economy of a country.

The impact of inflation on the supply and demand

“Global prices of food commodities have experienced a significant growth rate since the second half of 2007, which was brought to 2008 as well. Considerable acceleration occurred mainly in Q3 and Q4 2007. In 2007, global growth of food prices reached 15.1% (on a year-to-year basis they grew by 25.6 % in December). Food commodity prices reach their historic peaks, and in comparison with the levels from 2005 they have grown by 78 % on the average. One of the most important factors contributing to high food commodity prices is increased demand in the long term. Dynamics of the growth of demand for food products are higher than dynamics of the growth of commodity production.” (Ing. Marek Árendáš, PhD. Národná banka Slovenska)

The population is goes on increasing. But the available land for cultivation remains the same or decreasing because of sea level rise due to global warming. Though the advanced technologies have succeeded in increasing the yields, weather calamities and natural disasters retard the progress of agriculture. A good share of land where previously food crops were cultivated has been utilized for growing plants which produces bio diesel. Thus the food supply has reduced considerably though the demand goes on increasing. Thus the supply is not enough for the demand which resulted in higher inflation. Energy price is another important factor which influences the

Inflation and global economy 6

price of food commodities. The strong economic growth of Asian countries like India and china has increased the demand of crude oil.

There are two factors which raises the prices to alarming levels; “demand-pull” inflation and Cost-push inflation. First one is “too much money chasing too few goods—or “demand-pull” inflation. The idea here is that there are periods during which people have the means and desire to buy more goods and services than the economy can produce. Because demand is high and supply is limited, prices are bid up, resulting in higher inflation”. As per Cost-push inflation theory, when companies experience an increase in their costs—whether related to wages, supplies, taxes or some other expense—they attempt to maintain their profit margins by “pushing” those increases onto consumers in the form of higher prices”. (Oppenheimer Funds Investor Education Series)

Inflation impact on the Investment in the United States

Because of the fluctuations in the inflation and economy the investors are very cautious nowadays. Majority of the investment options have high risk factors under the dipping global economy. So investors are so particular in selecting their investment options currently. “In terms of fixed income investments, short- and intermediate- term bonds are one choice. They limit exposure to rising rates by maintaining relatively short-duration portfolios. Basically, this means that their prices are less sensitive to either rising or falling interest rates. Many of these funds invest in U.S. Government and agency securities, which are considered to have the highest credit quality. High yield bond funds are normally less affected by interest rate changes than by the condition of

Inflation and global economy 7

the overall economy. However, because they are lower rated, they are at more risk of default than investment-grade securities.” (Oppenheimer Funds Investor Education Series)

‘Commodity related investments are another option for the investors in the current inflated economic situations. Such commodities include oil, livestock, wheat, metals etc. Investments in commodity linked securities are considered to be comparatively safest way of investment. Real estate is another sector where investors can concentrate to overcome the risk factors produced by inflation’. (Oppenheimer Funds Investor Education Series)

Diversified real estate segments have to be selected for such investments. In any case a balanced diversified investment approach often considered as the safest way to tackle the problems caused by inflation. Bulk investment in a particular investment sector often ended in loss. It is just like a lottery. At times you may achieve jackpots; but many times you will be on the losing side

Conclusion

Inflation is a global economic phenomenon which often causes headaches to investors, economists, and the governments because of its unpredictability. The optimum value of inflation rate is also debatable among economists. Lower inflation rate and higher inflation rate; both have potential dangers. Inflation often occurs when the demand exceeds the supply.

Inflation and global economy 8

References

1. Rebecca Hellerstein, 1997, The Impact of Inflation, Retrieved on 23/1/09

< http://www.bos.frb.org/economic/nerr/rr1997/winter/hell97_1.htm>

2. Aarati Krishnan, The impact of inflation, Retrieved on 23/1/09

3. Ing. Marek Árendáš, PhD. Národná banka Slovenska, Global growth of food

commodity prices and the impact on inflation and monetary policy, Retrieved on 23/1/09,

4. Oppenheimer Funds Investor Education Series, Understanding the Impact of

Inflation, Retrieved on 23/1/09,

Read

More

CHECK THESE SAMPLES OF The Impact of Inflation on Global Economy

The Causes of Inflation and Deflation

This paper ''The Causes of inflation and Deflation'' tells that Every economy wants price stability and to reach this goal, the rate of inflation and deflation should be equilibrium.... This environment is one of the current examples of inflation and deflation that is happening in reality.... he main thrust of this paper is to discuss the causes of inflation and deflation, and how these affects corporate decision-making.... This type of inflation occurred when the supply of moon the circulation is high, causing the purchasing power of people to increase and eventually lead to demand-pull inflation....

8 Pages

(2000 words)

Essay

Unconventional Monetary Policies

the impact of the unconventional monetary policies on price level in the past has been observed as to weaker and less persistent.... he impact of the unconventional monetary policies on the price level in the past has been observed as to weaker and less persistent.... For example, the quantitative easing of the Bank of Japan has been considered as being ineffective at the zero lower experienced from 2001 as the central bank sheets were on the global financial crisis and monetary policy shifts that were exogenous similar to the commodity prices conditioning importance as an indicator used in conventional monetary policy identification....

14 Pages

(3500 words)

Term Paper

Inflation and Deflation in the Czech Republic since 1998

These changes have surely affected the progress of its economy both positively and negatively.... Even though the following governments tried some measures to keep economy strong, nothing could help.... Policy was framed to strengthen economy following the footsteps of the already developed economies.... This change could create some positive signs in economy.... Soon the state started making remarkable growth in its economy....

5 Pages

(1250 words)

Essay

Monetary Policy and Inflation of UK

The author of this paper 'Monetary Policy and inflation of UK' states that from the contemporary macroeconomic perspective, inflation targeting (IT) is considered to be one of the most important aspects of the monetary policy.... The United Kingdom, like many other regimes that adopted inflation targeting, try to achieve credibility through price stability.... This particular paper aims to discuss and analyze the model of UK monetary policy and its continuous impact on current inflation....

5 Pages

(1250 words)

Term Paper

Inflation and the UK Economy

The discussion should be mainly concentrated on the nature, cause, and impact of inflation in the U.... ‘s inflation rand its fluctuation rate in the economy and its effects on.... The paper "Inflation and the UK economy" is a great example of a report on macro and microeconomics.... 's inflation and its fluctuation rate in the economy and its effects on different sectors.... The paper "Inflation and the UK economy" is a great example of a report on macro and microeconomics....

9 Pages

(2250 words)

Macro-Economic Tools Used to Avoid Deflation and Its Side-effect on the Economy

Since the phenomenon of globalization has observed in the global economy, it is identified that Eurozone has faced a recession several times.... Notably, during the recovery phase, the Eurozone has witnessed certain challenges in terms of inflation, which has weakened the economic condition of the zone.... The paper "Macro-Economic Tools Used to Avoid Deflation and Its Side-effect on the economy" is an outstanding example of a macro & microeconomics assignment....

14 Pages

(3500 words)

Assignment

Inflation Against Deflation

Discussion The global economy is reliant on credit or money.... There needs to be a balance in the supply of money in the economy to avoid both inflation and deflation.... To that effect, the money supply is the total amount of monetary assets that are available in a nation's economy at a certain time.... The supply of money should keep pace with the expansion of the economy along with an increase in the population.... inflation occurs if the there is too much money in the system as compared to the demand of commodities....

7 Pages

(1750 words)

The Ever Decreasing Effects of Monetary Stimul

Of these, the role of the United States of America is highly profound and influential in shaping the global economy because of the powerful and influential nature of the nation.... The monetary and fiscal policies employed in different economies play a crucial role in determining the global economic landscape.... The primary research objective for the study is to analyze how the Austrian economists have been able to predict the massive inflation experienced in the global economic construct after the implementation of the Quantitative Easing 1 and Quantitative Easing 2 by the United States Federal Reserve in the years 2009 and 2010, respectively....

11 Pages

(2750 words)

Research Paper

sponsored ads

Save Your Time for More Important Things

Let us write or edit the literature review on your topic

"The Impact of Inflation on Global Economy"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY